If you’re like us, every month you reluctantly hand over your hard-earned cash to pay your credit card bills. And while it’s the right thing to do, sometimes it feels like you’re not making any headway on the debt.

If you’re like us, every month you reluctantly hand over your hard-earned cash to pay your credit card bills. And while it’s the right thing to do, sometimes it feels like you’re not making any headway on the debt.

Truth be told though, millions of Americans are not taking advantage of a simple way to take a bigger bite out of their credit card debt. In other words, you could be paying your credit card bill all wrong.

Here’s how you could be paying off your credit cards all wrong

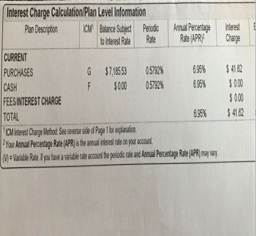

If you take the time to look at your credit card statements, especially paper ones, you’ll see a box. That’s where you’ll find your annual percentage rate (APR) and interest charge. Those figures will clearly tell you what the bank is charging you for outstanding debt. Now, the best case scenario is to avoid interest charges altogether by paying off your card in full every month, but if that’s not possible here’s how to avoid one of the worst credit card mistakes people make.

Money expert Clark Howard says that most people, if they have, say, three credit cards, will just pay more toward one of them almost haphazardly. But if you take a look at the interest rates for each card, you can see where the lion’s share of your money should be going.

As an example, say you have a credit card with a $5,000 balance and an interest rate of 21%. You also have a card with a $7,100 balance, but its interest rate is just 7%. Which one should you pay down first?

“If one is 7% and one is 21%, then the 21% is the one you should be paying,” Clark says. The reason is that you’re paying way more in monthly fees for the one with the higher interest rate, rather than the one with the biggest balance but smaller APR. Paying off the card with the higher rate will actually allow you to keep more of your money over the long term.

What we just described is a process called “laddering,” and it’s discussed in detail in Clark’s Guide to paying off credit card debt. “Pay more money toward that credit card and slightly less toward the other cards, until the card with highest-interest debt has a zero balance. Then you move onto the next card, and so on and so on,” he writes.

If you apply this strategy to your debt, you’ll not only be using your money wisely, but you’ll end up saving some as well.

Originally found here