We can learn many useful ways to manage the resources God has given us from the Bible. The following passage of scripture is a good example of managing resources that we should pay attention to.

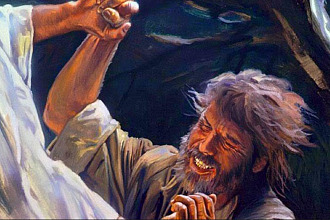

“A certain woman of the wives of the sons of the prophets cried out to Elisha, saying, ‘Your servant my husband is dead, and you know that your servant feared the Lord. And the creditor is coming to take my two sons to be his slaves.’ So Elisha said to her, ‘What shall I do for you? Tell me, what do you have in the house?’ And she said, ‘Your maidservant has nothing in the house but a jar of oil.’

Then he said, ‘Go, borrow vessels from everywhere, from all your neighbors—empty vessels; do not gather just a few. And when you have come in, you shall shut the door behind you and your sons; then pour it into all those vessels, and set aside the full ones.’ …Now it came to pass, when the vessels were full, that she said to her son, ‘Bring me another vessel.’ And he said to her, ‘There is not another vessel.’ So the oil ceased. Then she came and told the man of God. And he said, ‘Go, sell the oil and pay your debt; and you and your sons live on the rest.’” 2 Kings 4:1-7

We can learn a lot of things from this. This widow was in debt and needed help since her husband died and it is interesting to note that the first thing the prophet did was turn her attention to what was already in her house. When we are struggling with our finances we often are at a loss about what to do and focus on what we don’t have as the answer to our problems. But the prophet of God points us to what we already have for solutions.

While getting out of debt was a true miracle God didn’t just magically just drop money out of the sky for her. There was partnership between the human and the divine. “But remember the LORD your God, for it is he who gives you the ability to produce wealth, and so confirms his covenant, which he swore to your ancestors, as it is today.” Deuteronomy 8:18

God gives is the wisdom, power, and ability, but God expects us to make a personal effort to wisely use what was provided in order to better ourselves. Too often we think prayer and depending on God means doing nothing ourselves but that is not the case. We can use the principles found in this story to help us manage our finances. We may not have all the external resources we may want or need, but we should think about what can we do with what we already have in order to help us get out of debt so we can get what we need.

Perhaps you don’t have all the money we need to get out of debt right now but instead of buying expensive readymade meals maybe you can get the raw ingredients and make your own food for less money or use food you already have in the house even if it is less convenient so you can focus on paying off debts. Maybe you don’t have oil to sell but you have some things laying around the house you no longer need that you could sell on e-bay. Maybe you don’t have a brand name shirt you’d like but maybe you can find something you already own that can serve the same basic purpose that you can style nicely using the outfit you liked as inspiration without costing as much.

These things are just examples but point is think of what resources are available to you and how you can make the most out of it in order to avoid waste and needless spending. Getting out of debt takes an investment of time and effort. You may need to take more time to evaluate and plan purchases in advance, but little changes that lead us to depend more on using what we already have and making the most of it instead of focusing on what we don’t-which tends to lead to more loans and debt-can make a huge difference over time.

Also, when things are going well financial remember the words of the Jewish prophet “…And he said, ‘Go, sell the oil and pay your debt; and you and your sons live on the rest.’” 2 Kings 4:7. Notice he did not say, now that you have successfully established a great plan to get money and are confident you will have a decent sized check in the bank go and spend it on anything you want and then worry about your debts and how you will pay the rent next month. He told her to take care of her debt first and then advised her to live on the rest with her family and we would be wise to do the same.

After getting a paycheck or a large sum of money it is easy to feel as if paying off debt or caring for other expenses is not as urgent because there is currently seems to plenty of money but that is misleading. The amount of debt you have represent money you don’t really own but owe so the actual amount of money you can afford to spend may be much less than you think. So, do not make the mistake of neglecting priorities for optional purchases. We should also save for unexpected circumstances like illness or death that can make debt pill up and not assume we can take care of our bills later and live without a backup plan. You can avoid a lot of financial trouble by making sure what needs to be paid is provided for before relaxing and spending money for anything else.

Picture originally found here